Top 5 Copy Trading Platforms You Should Know In 2024

2025.03.03 09:35

2025.03.03 09:35

In the most basic form of copy trading, it occurs when a trader replicates the positions of another trader, typically a more experienced one with a demonstrated track record.

There can be numerous reasons why a trader might choose to begin copy trading, for instance, due to a lack of experience or an insufficient amount of time to monitor the markets.

For beginners, copy trading sounds so good that all you need to do is just simulate the practices of master traders and generate your income. However, every coin has two sides.

In this article, we’ll explore everything you need to know about copy trading, including what copy trading is, how to do it and its advantages and risks.

What Is Copy Trading?

Copy Trading, also known as social trading or mirror trading, which allows you to replicate the trading activities of other successful traders. This method leverages the expertise and proven performance of experienced traders by enabling you to execute the same trades as those experienced traders in their own accounts.

Simply put, it's like hiring a personal trading mentor without having to physically interact or understand the complex schemes of the market.

When talking about copy trading, there are three major elements involved:

1. Provider: This refers to the trader whose trades are being copied. Provider can also be called “Signal Provider” or “Master Trader”.

2. Copier: This refers to the person who is copying a provider’s trades with their own account.

3. Broker: This refers to the person who provides access to the copy trading platform, which connects the provider and the copier.

How Do You Copy Trade?

1. Choose a Reputable Trading Platform or Broker

When you want to copy someone’s trades, first you will need to select a platform or broker that offers copy trading functionality. They allow you to browse profiles of experienced traders, often categorized by their performance metrics, such as profitability, number of trades, and risk levels. Keep in mind that it is always important to conduct your own research to determine which one would be the most suitable for you.

2. Open an Trading Account

To create a trading account, you need to sign up for a live account with your broker. Prior to that, check your broker's rules and regulations as this will determine the degree of security and fund safety offered. Opening an account is a quick process and can be completed within a few minutes.

3. Deposit Funds into Your Account

Once you've identified a trading platform and opened your account , you can initiate the copy trading process. This typically involves allocating a certain amount of your trading capital to mirror the trades made by the selected trader(s).

The minimum deposit requirements you need to start copy trading varies between different platforms. Some platforms may require you to deposit at least $10 for your copy trading, while others may require a little more, so check the specifics for your chosen platform.

4. Select a Trader to Copy

Choose a trader that you want to follow. It’s always recommended to follow more than one master trader, which allows you to earn money even if one trader doesn’t perform well.

Remember, while copy trading can streamline your trading experience and potentially boost your returns, it's essential to carefully select traders and monitor your copied portfolios regularly to ensure they still align with your financial objectives.

5. Allocate Your Deposit

You will need to decide how much of your account deposit you want to use to copy the trader that you choose. Remember not to put all eggs in one basket as it will expose yourself to significant level of risks. You can copy multiple traders and allocate each trader a certain percent of your deposit if desired.

6. Start Copy Trading

After all the above mentioned have been done right, the platform will automatically start your trading, and you don’t need to do anything else.

What you need to do is to monitor the results of the trading in your account. If you feel that a trader is underperforming, you can stop following him. Or if you find a trader who is doing exceptionally well, you can allocate more money to them.

The Best 5 Copy Trading Platforms

Copy Trading platforms allow investors to browse through profiles of experienced traders, review their past performance, risk management strategies, and trading style before deciding which traders to follow. Here are some of the best copy trading platforms that you can step in.

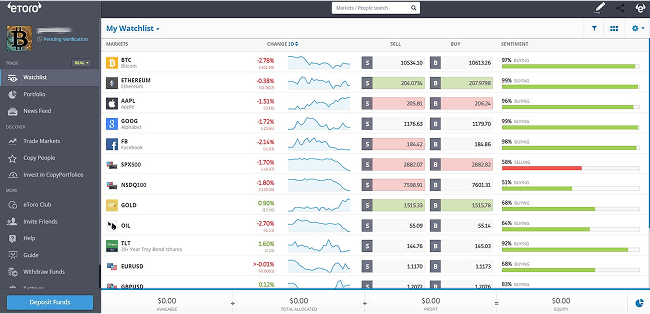

1. eToro

eToro is one of the most popular social trading platforms worldwide where users can interact with each other, share their insights, and follow successful traders.

eToro allows users to filter traders by their nationality, strategy, performance, and other factors to meet their goals. Moreover, its immense base of established social traders and functionality make it effortless for users to communicate with traders and replicate their trades.

Minimum Deposit: $200

Fees: eToro don’t charge you extra fees to use its CopyTrader

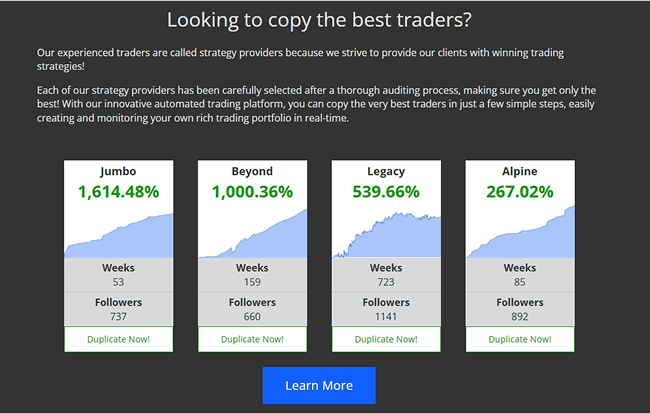

2. DupliTrade

DupliTrade is designed for experienced copy traders who want to automate their copy trading. For these copiers, DupliTrade's automation offers an even more hands-off approach to trading: Pick your traders, configure your settings, and let the software handle the rest.

It is an ideal product for a specific group of copy traders. However, it should be used with great caution and is not recommended for novice copy traders.

Minimum Deposit: $5000

Fees: It depends on the broker you select. Generally, it is around $100 plus small commissions.

3. NAGA

NAGA is known as a stock&crypto trading social network. It allows users to trade stocks, forex, indices, commodities and cryptocurrencies all on its platform.

It is beginner-friendly and has a novel interface for increased social sharing and public media integration. In addition, NAGA enables users to earn tokens and bonus for their trading activities and engagement on a rewarding platform they provide.

Minimum Deposit: $250

Fees: 0% commission on trades. CFD on shares is charged 0.2% per lot to copy trade while those on ETFs 0.1% per lot. Average spread is 2.5 pips.

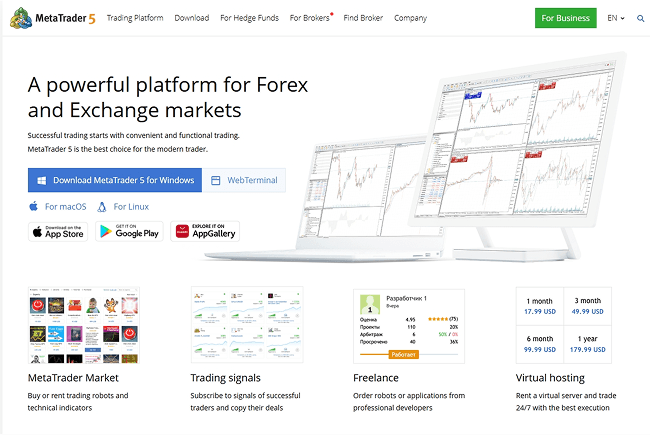

4. MetaTrader

Both MT4 and MT5 are extremely powerful platforms that are highly esteemed by trading professionals. It truly stands out for forex copy trading because of its speed, reliability, and advanced functionalities.

Withdrawals and deposits are free of charge. However, to use MT5, you must sign up through a broker. The broker will have other requirements for account opening that you need to take into consideration.

Minimum Deposit: Usually around $500

Fees: Depends on the broker and the asset being traded.

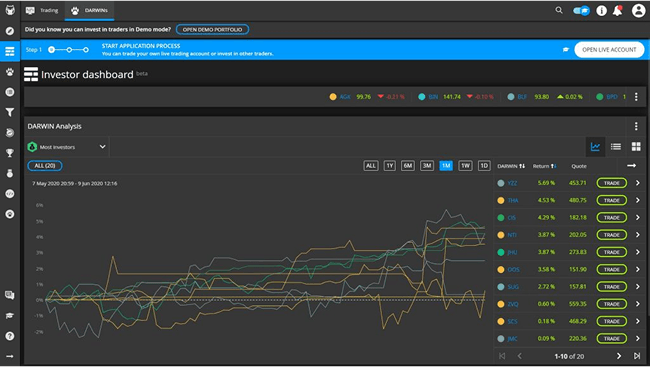

5. Darwinex

Darwinex take risk management seriously by providing advanced tools to safeguard users’ funds. Users can choose the best practices to follow using Darwinex’s detailed analytics and performance evaluations. Darwinex functions as a regulated broker, offering an additional layer of security for investors.

Minimum Deposit: $500

Fees: Charges a 20% performance fee on any 3rd party profit in DARWINs (15% is for the DARWIN provider and 5% for Darwinex) using the HWM (high-water mark) method.

Pros and Cons of Copy Trading

Copy Trading carries both advantages and disadvantages that you should carefully consider before embarking on this journey.

Pros of Copy Trading:

1. Convenience and Simplicity

One of the primary benefits of copy trading is its ease of use. Investors can piggyback on the expertise of professionals without having to conduct extensive market research or develop their own trading strategies. This makes it accessible to traders of all experience levels, including beginners.

2. Diversification

By copying multiple traders, investors can diversify their portfolios across different asset classes, trading styles, and risk profiles. This diversification can help reduce overall risk and potentially enhance returns.

3. Time-Saving

Active trading requires constant monitoring and analysis, which can be time-consuming. Copy trading allows investors to free up their time by letting others do the work for them, freeing them to focus on other aspects of their lives.

4. Reduced Emotional Trading

Emotions often play a significant role in trading decisions, leading to impulsive trades and poor judgment. By mirroring experts' trades, investors can avoid making decisions influenced by fear, greed, or other emotions.

Cons of Copy Trading:

1. Reliance on Others

The biggest drawback of copy trading is its reliance on the performance of the traders being copied. If these traders make mistakes or encounter a prolonged period of underperformance, investors' portfolios will suffer as well.

2. Lack of Control

Investors lose direct control over their portfolios when copying other traders' actions. This lack of autonomy can be unsettling for some traders who prefer to make their own decisions.

3. Hidden Fees

Some copy trading platforms charge fees for their services, either as a percentage of profits or through subscription fees. These costs can reduce investors' overall returns and may not be immediately apparent.

4. Potential Scams

The copy trading industry is not immune to scams, where unscrupulous traders or platforms promise unrealistic returns to attract investors. Thorough research and due diligence are essential to avoid falling victim to these schemes.

An Alternative Way to Do Crypto Trading

After reading this article, you must already have a clear understanding of what copy trading is and how to start your copy trading, but there are also some ways to earn free crypto too.

If you want to maximize your profits, you’ll need to run and manage multiple accounts as only one account won’t get you as much income as you wish. However, running multiple accounts will likely be detected and banned by platforms you choose.

That’s where BitBrowser can help. BitBrowser is one of the best anti-detect browsers that enable you to run multi-accounting while stay anonymous. It can simulate different browser profiles, making your accounts look more real and natural. Through BitBrowser, you can easily create and manage multiple independent accounts of a single platform. Each account has a unique identity and browser fingerprint, effectively avoiding the risk of accounts being suspended.

Sign up for BitBrowser for free and maximize your profits.

BitBrowser

BitBrowser

Multi-Account Management

Multi-Account Management Prevent Account Association

Prevent Account Association Multi-Employee Management

Multi-Employee Management